Money Transfers to Card: What Amounts are Now Under Tax Monitoring.

Taxation of Transfers Between Bank Cards

In light of the increased interest among citizens regarding the taxation of money transfers between bank cards, journalist Irina Polyakova provided clarifications on the key aspects of this issue in her latest video release on the channel 'On Pension'. She focused in detail on what revenues are considered income, which are exempt from taxes, and how to avoid potential issues with tax authorities.

'Recently, we released a video about taxes on card transfers, and the topic sparked significant interest among you. Almost 1000 comments were gathered,' Polyakova noted at the beginning, emphasizing the relevance of the topic for Ukrainians.

What is Considered Income and How is it Regulated?

Irina Polyakova emphasized that the taxation rules for transfers are not a new introduction. According to Article 14 of the Tax Code, income is defined as 'the total amount received by a person from all types of their activities during a certain reporting period.'

Which Transfers are Not Taxed?

- Transfers from relatives of the 1st and 2nd degree of kinship (parents, husband/wife, children, etc.).

- Pensions, scholarships, and state assistance.

- Assistance from international organizations and charitable foundations.

- Other exceptions related to loans, gifts, insurance payments, etc.

The Myth of Double Taxation and Real Penalties

Irina Polyakova explained that failure to pay taxes can lead to serious fines and consequences. Instead, she emphasized the importance of clearly indicating the purpose of payment to avoid double taxation. She also spoke about new monitoring rules for tax authorities that provide access to foreign accounts and regulate operations through financial companies.

Read also

- The US banking sector awaits historic regulatory easing

- The European Union may fine TikTok up to 6% of its turnover

- Warning signals from Poland: Gazeta Wyborcza reported a rise in hostility towards Ukrainians

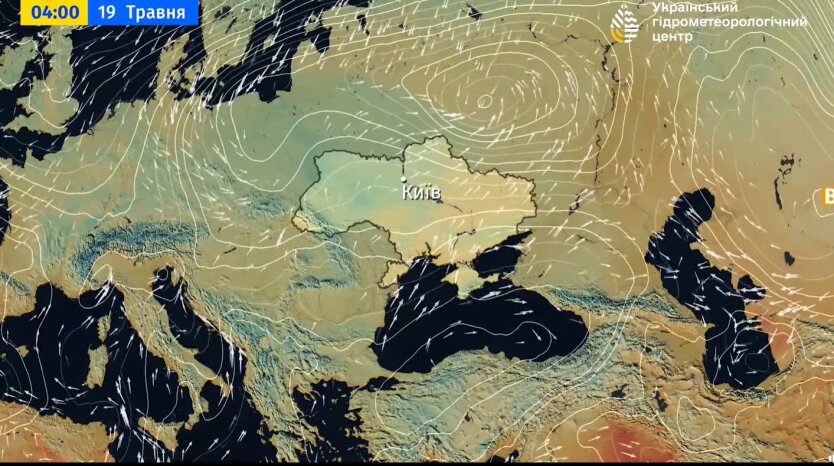

- Weather forecast for May 17-18: temperature contrasts, rain, and unstable weather

- Russia threatened to capture two more regions of Ukraine during negotiations: The Economist revealed details of the blackmail

- Zelensky discussed the results of the Istanbul negotiations with Trump and EU leaders, Umierov shared the details